Bad Debts Written Off Journal Entry

Otherwise a business will carry an inordinately high accounts receivable. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry.

Bad Debt Recovery Financiopedia

Sometimes businesses are able to recover a bad debt that had been previously written off.

. When A Previously Written Off Bad Debt Is Recovered. Web Bad debt is debt that is not collectible and therefore worthless to the creditor. Is a manufacturing concern with two stitching units.

The concept of Asset Disposal is illustrated in the following example. Use Other Deposits to Target Bad Debt Expense. Accounting Treatment for Asset Disposal.

Web General allowance refers to a general percentage of debts that may need to be written off based on your businesss past experience. The recovery of a bad debt like the write-off of a bad debt affects only balance sheet accounts. The credit balance on the account is then transferred to the credit of the statement of profit or loss added to gross profit or included as a negative in the list of expenses.

Not all debtors pay their dues every time. Accounting Adjusting Entries Quiz. Later when a specific account receivable is actually written off as uncollectible the company debits Allowance for Doubtful Accounts and credits Accounts Receivable.

While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should. Web When a customer pays after the account has been written off two entries are required. Partially or fully irrecoverable debts are called bad debts.

It is known as recovery of uncollectible accounts or recovery of bad debts. The allowance method is preferred over the direct write. Web This implies that some of the credit customers might not pay their debts in time because of which they need to be written off from the financial statements.

It is not directly affected by the journal entry write-off. Web Nebraska is a 2013 American comedy-drama road film directed by Alexander Payne written by Bob Nelson and starring Bruce Dern Will Forte June Squibb and Bob Odenkirk. For long-term investments that have been unable to be fulfilled businesses might be required to write off the amount in order to ensure that the long-term investment is duly removed from the.

At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment this is called the recovery of bad debts. Read more is recorded as a direct loss from defaulters writing off their. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss.

Web A bad debt can be written off using either the direct write off method or the provision method. Web The debit to bad debts expense would report credit losses of 50000 on the companys June income statement. Shot in black-and-white the story follows an elderly Montana resident and his son as they try to claim a million-dollar sweepstakes prize on a long trip to Nebraska.

This may be clearer than crediting the recovery to. Bad debt is a loss for the business and it is transferred to the income statement to adjust. Bad debts provision Bad Debts Provision A bad debt provision refers to the reserve made by a company to set aside an amount computed as a specific percentage of overall doubtful or bad debts that has to be written off in the next year.

The first approach tends to delay recognition of the bad debt expenseIt is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible. Web The Bad Debts Expense remains at 10000. Above we assumed that the allowance for doubtful accounts began with a balance of zero.

Web The accounts receivable aging will look good. The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below. Web Below are the examples of provisions for a bad debt journal entry.

Select your general ledger Bad Debt expense account. Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the creditors cost of. Using the Other Deposits tab enter a negative value amount for the write-off.

Web The entry will involve the operating expense account Bad Debts Expense and the contra-asset account Allowance for Doubtful Accounts. 1 The entry made in writing off the account is reversed to reinstate the customers account 2 The collection is journalized in the usual manner. When this happens the balance.

Web Sometimes a debt written off in one year is actually paid in the next year a debit to cash and a credit to irrecoverable debts recovered. In such cases the business must reverse the previous entry made to Accounts receivable and Bad Debt Expense Account. Provision for doubtful debts should be included on your companys balance sheet to give a comprehensive overview of the financial state of your business.

Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name. Example 1 As on 01012012 Provision for Bad Debts Bad Debts Bad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other. Web Partially or fully irrecoverable debts are called bad debtsAccounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors NameBad debt is a loss for the business and it is transferred to the income statement to adjust against the current periods incomeBad debts recovered.

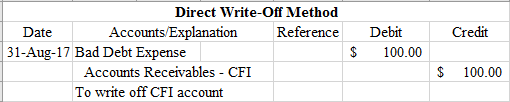

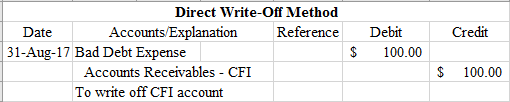

Web Journal Entry for Recovery of Bad Debts. The Bank Deposit record will now total to zero. Web 1 Direct Write-Off Method.

However the customers sometimes pay the amount written off as bad debts. Web In the journal entry it debits bad debt expenses while crediting the amount it expects to be paid. Web A account receivable that has previously been written off may subsequently be recovered in full or in part.

We effectively moved the bad debt problem to Undeposited Funds. Web To write off bad debts expense for the amount owed by ABC Co. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this.

This article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from him. Web Try Another Double Entry Bookkeeping Quiz. When a doubtful debt turns into bad debt businesses credit their account receivable and debit the allowance for doubtful accounts.

Web The journal entry above shows that the treatment required to reduce accounts receivables as well as record the written-off accounts as an expense in the financial statement. Otherwise your business may have an inaccurate picture of the amount of. Web Journal Entry for Bad Debts.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Accounting For Bad Debts Journal Entries Direct Write Off Vs Allowance Youtube

Writing Off An Account Under The Allowance Method Accountingcoach

Bad Debt Overview Example Bad Debt Expense Journal Entries

Writing Off An Account Under The Allowance Method Accountingcoach

0 Response to "Bad Debts Written Off Journal Entry"

Post a Comment